If you're an on-paper, on-purpose type of person when it comes to handling your personal finances, download one of our budget forms or other useful spreadsheets.

Use the Monthly Cash Flow form to set up your basic monthly budget. This form helps you prioritize while giving every dollar a name.

What's your net worth? Find out with this form by determining how much you owe versus how much value each asset has.

Give every dollar a name. Use this form to break down each paycheck and tell your money where to go.

Use this form to help you calculate and save for expenses that happen on a non-monthly basis.

New to budgeting? This is a great place to start and get your feet wet!

If you work multiple jobs or have other streams of income, you can get them all down in one place here.

If you have kids, you're probably well aware of the rising cost of college. Planning is the secret to a college education without student loans. This form helps you determine how much you'll need to plan.

Many of us have irregular incomes. If you're self-employed or work on commission, this form will help you plan for your expenses.

How much do you need to budget for groceries? This form outlines Dave's recommended percentages for each category, making it easier to set up your budget.

This form lists all of the important documents you need for a healthy and organized financial plan.

Keep all your credit card numbers and contact information here so you know what was paid, when it was paid, and where the money was sent.

There are many types of insurance coverage. With this form, you can keep track of your coverage types, your agent's name, your premium amount and more.

How much do you need to retire comfortably? Use this planning sheet to figure out how much you need to save each month for retirement.

Here, you can write down your savings goals for various expenses and update the balances as they grow.

This is the fun one! Get your debt snowball rolling. List all of your debts smallest to largest, and use this sheet to mark them off one by one.

If you can't pay your debts in full each month, this form helps you calculate how much each creditor gets paid right now.

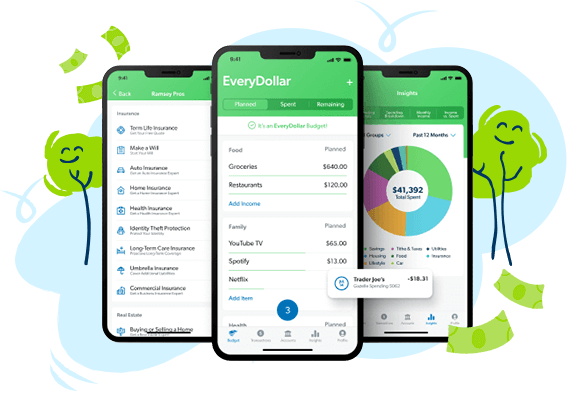

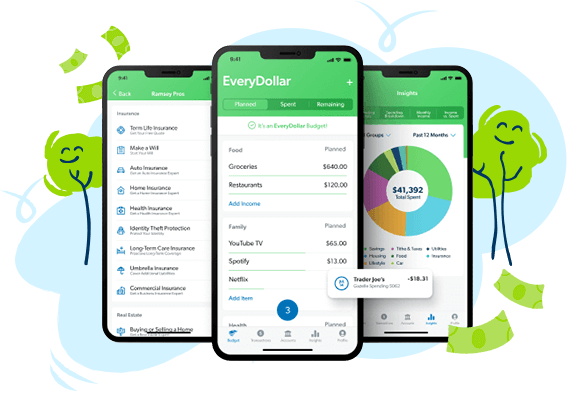

Go digital with your budget. Try EveryDollar—our zero-based budgeting app. Track your spending, see your goal progress, and create unlimited budgets without having to shuffle a stack of paper. The trees will thank you.

To give you the best online experience, Ramsey Solutions uses cookies and other tracking technologies to collect information about you and your website experience, and shares it with our analytics and advertising partners as described in our Privacy Policy. By continuing to browse or by closing out of this message, you indicate your agreement.